Moby.co Review Summary

In our Moby.co review, we found it to be the most ambitious platform and one of the best entry points for investment-minded individuals. From analysis to community features and its own funds, whether you are interested in short or long-term trading, Moby has plenty to offer. We gave it 4.5/5 stars.

Quality

Pricing

SUPPORT

Community

Content

Disclosure: We are reader-supported. If you buy through links on our site, we may earn a small commission. Learn more.

Key takeaways from this review:

- Great analysis of various markets, especially the stock market.

- The option to invest in different funds provided by Moby, along with an explanation of how they work.

- Lots of trader tools in one place.

Moby.co Pros & Cons

Pros

Cons

What is Moby.co?

Moby is a platform aiming to, in a sense, democratize investing by making it easier and more accessible for everyone, regardless of their experience level. In short, it’s a investing research platform.

Moby curates and simplifies investment research from various sources, presenting it in easy-to-understand formats like articles, videos, and infographics. This newer platform is emerging as the frontrunner of being the Motley Fool alternative.

This helps you navigate the overwhelming world of financial information and gain key insights so you’re able to make profitable, smarter, and more decisive investments into the best stocks in the market

The paid subscription provides tailored investment recommendations and daily market updates delivered straight to your inbox. Think of it as having your own pocket investment advisor for a relatively low fee.

Many existing investors use Morningstar, Seeking Alpha, or even Zacks, with staying up to date on the market.

Now, many are looking to Moby as the bridge of financial news, tools and stock picks, by providing clear guidance on questions like:

- What are the best growth stocks to buy now?

- Why might crypto be a great investment?

- How can I buy stocks online with the lowest fees?

Who is Moby.co for?

Moby might not be a one-size-fits-all solution, but it can be a great fit for specific investor profiles:

Ideal Users:

- New Investors: Feeling overwhelmed by financial jargon and complex analysis? Moby bridges the gap, simplifying investment research and concepts through digestible formats like articles, videos, and infographics.

- Busy Professionals: Short on time for in-depth research? Moby.co curates the most relevant information, saving you hours of scouring various sources.

- Passive Investors: Prefer a hands-off approach? Thematic portfolios offer diversification and automatic rebalancing, minimizing active management needs.

- Cost-Conscious Investors: Moby's free basic service provides valuable insights, while the paid "Premium" tier remains relatively affordable compared to traditional financial advisors.

Core Reasons to Switch:

- Demystify the jargon: Moby translates confusing financial terms into easy-to-understand language, making investing less intimidating.

- Cut through the noise: They curate research from multiple sources, saving you time and filtering out irrelevant information.

- Visualize your options: Infographics and video presentations make data and trends more engaging and digestible.

Invest Smarter, Not Harder:

- Thematic portfolios: These ready-made investment options, built using machine learning, offer instant diversification based on specific trends or industries.

- Automated rebalancing: No need to constantly monitor and adjust your portfolio; Moby handles it automatically, ensuring optimal asset allocation.

- Personalized insights (Moby Premium): Get tailored recommendations based on your goals and risk tolerance, like having your own pocket investment advisor.

Moby.co Features: Stock picks, fund selection and more

Being an educational platform, Moby's features are investment advice with commentary and an outlook of recent events.

As many investors in the market look to use Motley Fool’s stock picks, Moby is the emerging investment research and stock picking service that may claim the title of the latest and greatest Motley Fool.

Why Motley Fool versus Moby?

Moby has shown it’s investors some top performing picks over 2023, which include:

Moby 2023 Top 5 Picks Returned:

- NVDA: 233.28%

- ELF: 146%

- PLTR: 142%

- META: 105%

- WAYFAIR: 87%

The growing trend of investors looking for Motley Fool’s 10 best stocks are looking at Moby as the alternative solution for a best stock picking service.

Here's what you can expect as a premium user:

1. Investment news

Here you can get news on how various top stocks in different sectors performed, which are up-to-date and decently analyzed.

2. Top picks

Moby's flagship feature, with detailed commentary on various stocks and why you might want to invest in them. Differs from news in that it's more of an outlook of performance to expect:

3. Moby funds

Regular updates on the funds Moby.co offers for investment, namely the ones outlined above. You'll learn what goes in and out and how Moby makes its decisions.

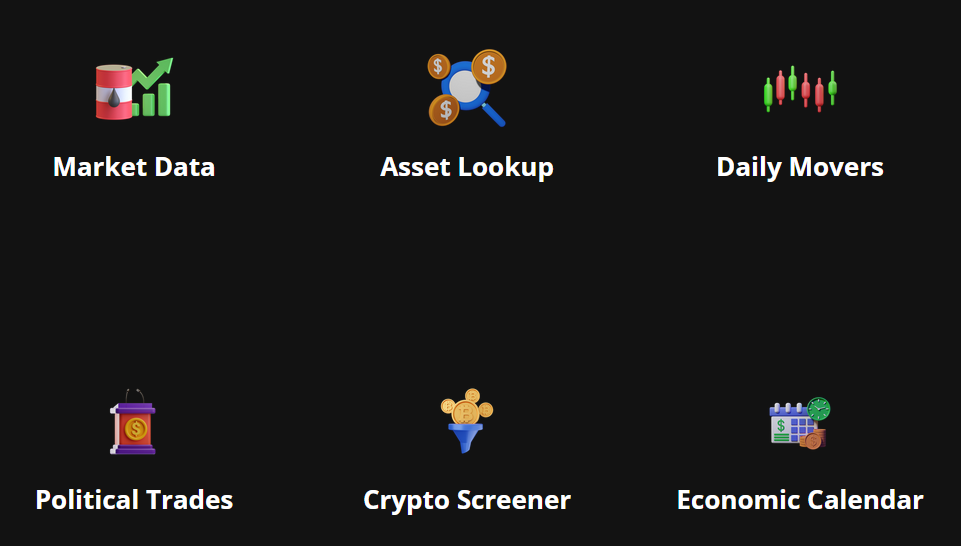

4. Moby Additional Tools

Some other useful features that aren't part of the main repertoire. However, there appear to be some bugs here. Political trades, for example, returns a 404 link.

Moby.co Mobile App

Moby come with a fully functional mobile app for both Android of iOS, but this user seems to think it's only available in that form:

This isn't true, however, as the web version works quite well with only some minor bugs that have yet to be addressed.

Moby.co Pricing & Plans

Moby offers two main pricing options:

1. Free:

- Access to basic investment research and articles.

- Watch educational videos and infographics.

- Browse sector rankings and lists.

- No access to personalized recommendations or in-depth analysis.

2. Moby Premium:

- Costs $29.95 per month or $4 per week billed annually.

- Get 3 stock picks with price targets every week.

- Receive monthly crypto research reports.

- Access video and audio versions of reports.

- Benefit from political trade tracking and hedge fund insights.

- Enjoy daily market newsletters and email/SMS alerts.

- Participate in their Discord community.

Moby.co Reviews & Ratings

Moby is featured on Trustpilot, Google App Store and iOS App Store.

Trustpilot gives them 4.5 stars with 175 reviews, most of them positive and the negative ones replied to.

Between the two mobile app review sites, they have over a thousand 5-star reviews, as stated on their website.

But, probably because they are so new, they don't have review profiles on any other notable sites yet, such as BBB.

Moby.co Customer Support

Moby.co support is a mixed bag, with some things we like to see present and some absent:

Available Support:

- FAQ Section: Their website features a detailed FAQ section that addresses common questions about the platform, features, and pricing. This could be a first point of contact for resolving basic inquiries.

- Email Support: They provide an email address ([email address removed]) for users to directly contact their support team. Response times and quality haven't been publicly documented.

- Discord Community: They offer a Discord community where users can interact and potentially find support from other users or moderators.

What's Unknown:

- Phone Support: There's no mention of phone support availability, so direct calls might not be an option.

- Live Chat: Similarly, live chat support isn't explicitly advertised on their website.

- Support for Premium Users: It's unclear if Moby Premium users receive any dedicated or prioritized support channels.

Moby.co Alternatives

Here are 3 alternatives to Moby.co that I personally prefer, along with some selected comparisons.

1. Acorns:

- Features: Acorns is a micro-investing app that allows you to invest spare change from everyday purchases. It also offers automated investing, thematic portfolios, and educational resources.

- Similarities to Moby: Both platforms offer educational resources and thematic portfolios.

- Differences: Acorns is focused on micro-investing and automated investing, while Moby offers more research and analysis tools. Acorns charges a monthly fee, while Moby has a free plan with a premium option.

- Who it's for: Acorns is a good option for beginners who want to start investing with small amounts of money.

2. M1 Finance:

- Features: M1 Finance is a brokerage platform that allows you to invest in stocks, ETFs, and fractional shares. It also offers automated investing, portfolio management, and borrowing against your portfolio.

- Similarities to Moby: Both platforms offer automated investing and thematic portfolios.

- Differences: M1 Finance is a full-fledged brokerage platform, while Moby.co is more focused on research and analysis. M1 Finance charges a transaction fee, while Moby has a free plan with a premium option.

- Who it's for: M1 Finance is a good option for investors who want more control over their portfolios and access to a wider range of investment options.

3. Robinhood:

- Features: Robinhood is a commission-free brokerage platform that allows you to invest in stocks, ETFs, options, and cryptocurrency. It also offers fractional shares and margin investing.

- Similarities to Moby: Both platforms offer commission-free investing.

- Differences: Robinhood is focused on individual stock picking, while Moby offers more research and analysis tools. Robinhood does not offer thematic portfolios or educational resources.

- Who it's for: Robinhood is a good option for experienced investors who want to trade individual stocks and options without paying commissions.

FAQs - Moby.co Review

Moby aims to simplify investing by offering curated research, thematic portfolios, and personalized insights (through their paid "Premium" option).

Yes, they offer a free basic plan that grants access to some of their features, such as basic investment research and access to sector rankings and lists.

Verdict: Should You Use Moby.co for Stock Market Research?

If you're looking for a user-friendly platform, helpful resources, and even hands-off investment guidance, I would easily recommend Moby. You might just find your new financial buddy in this platform, be it Moby itself or one of the community members you end up being introduced to.

Remember, investment isn't just about capital, but also prudence and responsibility. And with Moby by your side, you'll be off to a great start even if you're completely new to the thing.