BTSE Review

Key takeaways from our BTSE review:

- High Liquidity and Advanced Trading Tools

- Security and Privacy-focused Trading Platform

- Multiple Cryptocurrency Trading Options

BTSE Pros & Cons

What is BTSE?

BTSE is a cryptocurrency exchange platform that provides users with a secure, fast, and easy way to buy, sell, and trade digital assets. It offers a wide range of features, including margin trading, spot trading, and futures trading, as well as a variety of payment methods.

BTSE Exchange is a leading cryptocurrency exchange that offers a wide range of features to its users. It offers a secure platform for trading digital assets, including Bitcoin, Ethereum, and other popular altcoins.

BTSE Product & Features

BTSE provides a variety of features that make trading easy and efficient, such as advanced order types, margin trading, and low fees.

The exchange offers a comprehensive set of order types, including limit orders, market orders, stop-limit orders, and iceberg orders. These order types can be used to maximize profits and minimize losses. BTSE also offers margin trading, allowing users to leverage their positions to increase their profits.

BTSE also has low fees, which make it an attractive option for traders. The exchange offers a tiered fee structure, with lower fees for higher volumes. This makes it a great choice for both casual traders and professional traders.

BTSE also offers a variety of other features, such as advanced charting tools, portfolio management tools, and a mobile app. These features make it easy to track and manage your trades on the go.

Overall, BTSE is a great choice for traders looking for a secure and feature-rich cryptocurrency exchange. With its advanced order types, margin trading, and low fees, it is a great option for both beginners and experienced traders.

BTSE Futures

BTSE Futures are a significant part of the BTSE exchange, offering traders the opportunity to speculate on the future price of various cryptocurrencies.

Key Features of BTSE Futures:

- Diverse Range of Contracts: BTSE typically offers a variety of futures contracts, including perpetual contracts like BTC-PERP. These contracts allow traders to speculate on the future prices of major cryptocurrencies such as Bitcoin, Ethereum, and others.

- Leverage Options: One of the key attractions of futures trading on platforms like BTSE is the availability of leverage. This means traders can open positions larger than their existing balance, potentially amplifying gains (and losses).

- Risk Management Tools: To help manage the risks associated with high leverage and volatile markets, BTSE Futures likely provides various risk management tools. These might include stop-loss orders, margin calls, and other mechanisms to protect traders.

- Settlement Mechanisms: Futures contracts on BTSE may be settled in different ways, including cash settlement or physical delivery, depending on the nature of the contract.

- Market Liquidity: A robust futures market like BTSE's typically ensures ample liquidity, enabling traders to enter and exit positions easily without significant price impact.

- Intuitive Trading Interface: The platform probably offers an intuitive and user-friendly interface, catering to both novice and experienced traders, with real-time data, charting tools, and other essential trading features.

- Regulatory Compliance: As with most reputable trading platforms, BTSE Futures operations are expected to comply with relevant regulatory standards, ensuring a secure and trustworthy trading environment.

- 24/7 Trading: Given the nature of the cryptocurrency market, BTSE Futures trading is likely available 24/7, allowing traders to respond to market movements at any time.

BTSE Earn - Staking, Fixed & Flexible Savings

BTSE Earn offers a comprehensive range of options for cryptocurrency investors looking to maximize their returns through various earning mechanisms.This includes:

- Staking

- Fixed savings

- Flexible savings

- Lending services

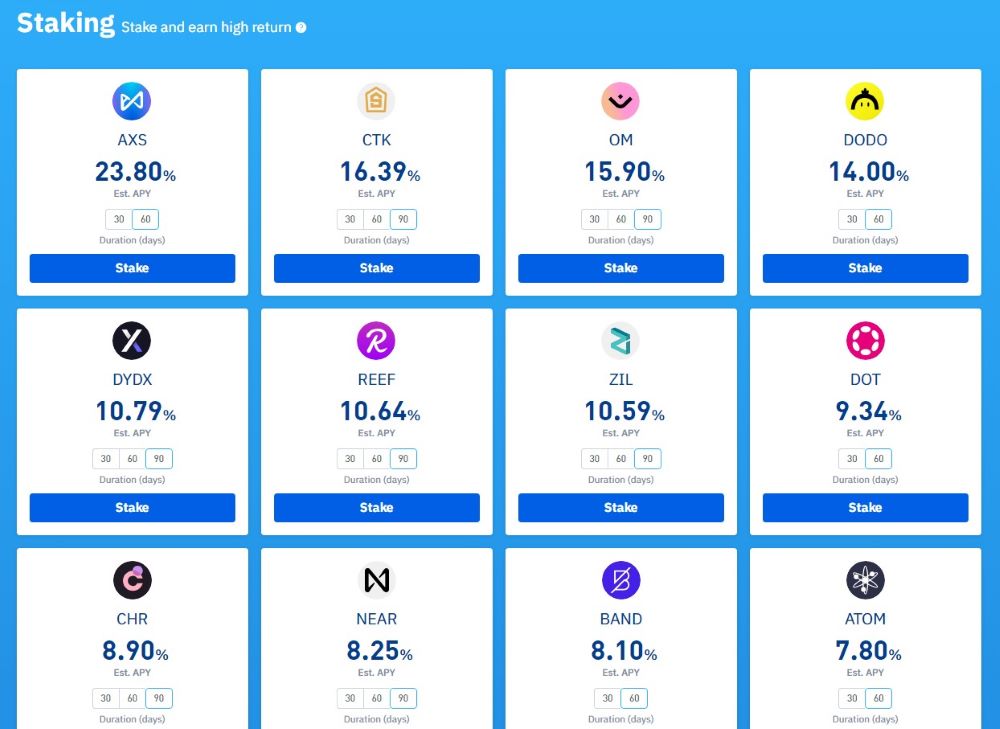

1. Staking on BTSE

Staking on BTSE allows users to earn significant returns on various cryptocurrencies. The platform provides estimated Annual Percentage Yields (APYs) for a wide range of coins, with the option to stake and earn high returns.

Some notable offerings include:

- AXS: 23.80% Est. APY

- CTK: 16.39% Est. APY

- OM: 15.90% Est. APY

- DODO: 14.00% Est. APY

- DYDX: 10.79% Est. APY

The list continues with over 50+ tokens including DOT, NEAR, ATOM, and ADA, each offering varying APYs and durations for staking.

2. Flexible Savings

Flexible Savings on BTSE allows for depositing, earning, and redeeming anytime, offering a more liquid option for investors. This includes competitive APYs on stablecoins and other major cryptocurrencies, such as:

- USDT: 7.00% Yesterday's APY

- USDC: 6.50% Yesterday's APY

- FDUSD: 6.50% Yesterday's APY

- BTC: 2.40% Yesterday's APY

- ETH: 2.40% Yesterday's APY

3. Fixed Savings

For those seeking more predictable returns, Fixed Savings offers higher annual percentage rates with set durations. This option suits investors looking for a more stable earning environment. It includes:

- USDT: 9.00% Annual Percentage Rate

- FDUSD: 8.30% Annual Percentage Rate

- USDC: 8.30% Annual Percentage Rate

4. Lending on BTSE

Lending involves earning interest by lending assets to BTSE's capital pool. This provides an alternative income stream, with annual percentage rates depending on the asset lent. Some options include:

- wHKD: 7.50% Annual Percentage Rate

- wUSD: 6.00% Annual Percentage Rate

- wSGD: 5.50% Annual Percentage Rate

- BTSE Token: 3.75% Annual Percentage Rate

BTSE Customer Support

BTSE provides 24/7 customer support through various channels, including email and live chat. The exchange also offers a comprehensive knowledge base and a dedicated support team to help users with any issues they may encounter. The team is highly responsive and strives to resolve customer inquiries and concerns in a timely manner.

Can US Citizens Use BTSE Exchange?

No, BTSE Exchange is not available to US-investors. BTSE Exchange is currently only available to residents of the United Arab Emirates, Saudi Arabia, Bahrain, Kuwait, Oman, and Turkey. BTSE Exchange does not accept customers from any other countries.

BTSE Trading Fees

The exchange offers competitive trading fees and a variety of payment methods.

Withdrawal Fees: BTSE Exchange does not charge any withdrawal fees.

Maker / Taker Fees: BTSE Exchange charges a maker fee of 0.2% and a taker fee of 0.2%. These fees are subject to change depending on the volume of trades.

Overall, BTSE Exchange offers competitive trading fees and a variety of payment methods. The exchange does not charge any withdrawal fees, and the maker and taker fees are subject to change depending on the volume of trades.

BTSE Alternatives

- Bitfinex: Bitfinex is a popular crypto exchange that offers advanced trading features such as margin trading, lending, and staking. It also has a user-friendly interface and a mobile app.

- Bitstamp: Bitstamp is a reliable and secure crypto exchange that offers trading in Bitcoin, Ethereum, XRP, and other cryptocurrencies. It also offers low transaction fees and a user-friendly platform.

- Crypto.com: Crypto.com is a regulated crypto exchange that offers trading in Bitcoin, Ethereum, and other cryptocurrencies. It also offers a user-friendly platform, a mobile app, and a secure custody solution for storing your digital assets.

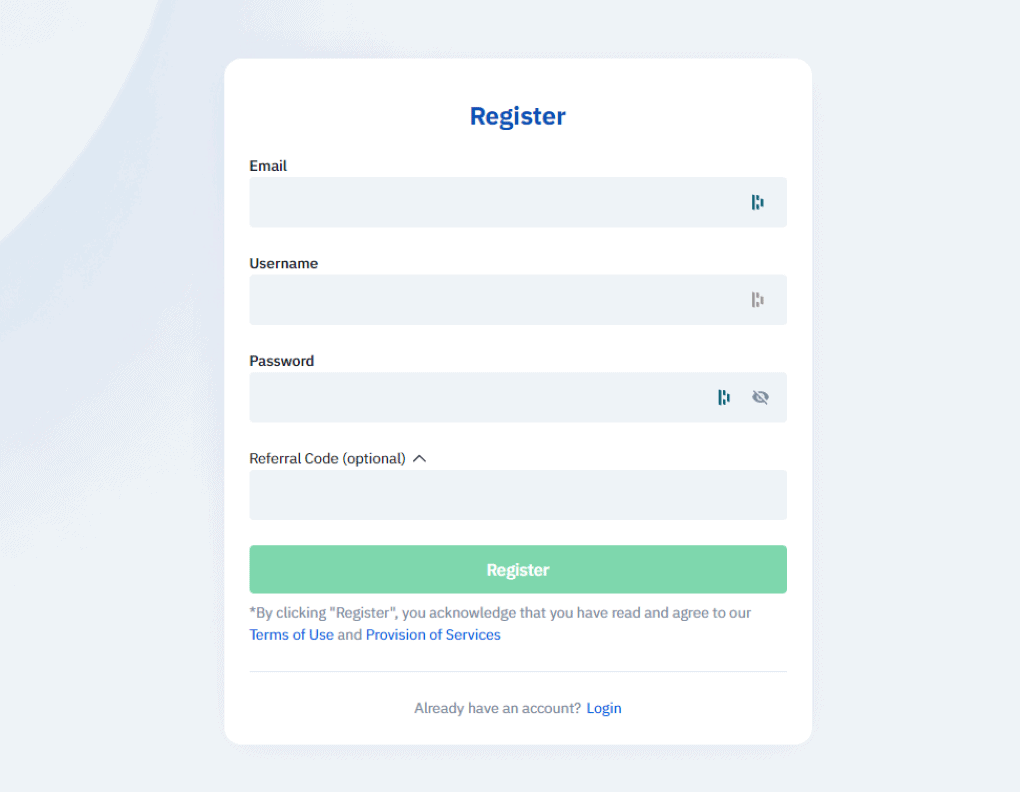

How to Sign up on BTSE Exchange?

Here are the step by step instructions on how you can sign up on BTSE Exchange.

- Visit BTSE Exchange

- Enter your email address, username and password.

- Click “Create Account”.

- Verify your email address.

- Log in to your account.